OZMOSI’s predictions for where Alzheimer’s treatment is headed.

The Ravaging Effects of Alzheimer’s

The devastation of living with an Alzheimer’s diagnosis is exponentially affecting more and more people. A 2019 study conducted by The Lancet estimated 57 million people globally were living with dementia, with an expected increase to 153 million people by 2050, matching data published by Alzheimer’s Disease International (ADI) in the World Alzheimer Report 2019. The authors of the Lancet study also state that dementia places disproportionate burdens on women, reflected in the ADI report on Women and Dementia in 2015.

Whether diagnosed with the disease or a caretaker to someone who is, the care and treatment of patients come at a steep cost to well-being and wallets. In 2019 the overall economic burden was measured to be an estimated $2.8 trillion globally – expected to reach $16.9 trillion in less than three decades.

The Most Recent Treatment Developments

Statistics like these demonstrate that it is imperative an effective treatment be introduced and approved soon for this growing patient population. A good deal of focus recently has been on two monoclonal antibodies by Eisai and Biogen, both of which are AB Degraders that reduce the buildup of amyloid plaques in the brain that are characteristic of the disease’s progression.

The first, aducanumab (Biogen – BIIB), generated controversy when it was greenlighted by the Food and Drug Administration (FDA) but had marginal cognitive benefits coupled with a very high price tag. The second, lecanemab (Biogen – BIIB, Eisai – ESALY), has been granted priority review by the FDA, and is differentiated from aducanumab in that it doesn’t require incremental dosing and can be started immediately at the highest dose.

The Timing and Impact of Treatment

To date, these types of treatments targeting the reduction of amyloid plaque have produced only marginal cognitive benefits in the treatment of Alzheimer’s. There is a school of thought emerging that perhaps we should treat the amyloid plaque before the cognitive symptoms occur, similar to how we treat high cholesterol as a risk factor for heart disease.

A neuroscientist at Harvard University, Rudolph E. Tanzi, suggests plaque-targeting treatment should start in the earliest stages because by the time cognitive decline kicks in, it may be too late. If we look to how the medical and public perceptions of heart disease and early treatment shifted between 1970 and 2000, we could learn quite a few lessons.

Through improved screening for high-risk patients with hypertension and high cholesterol during this period, associated mortality rates declined by approximately 60% in the US and Canada. If treating physicians and the pharmaceutical industry address Alzheimer’s the same way as coronary heart disease, treatments could start much sooner and, therefore, have a much greater impact.

What We Can and Should Do

What if we included an amyloid-beta blood test or PET scan as part of recommended screenings along with mammograms and colonoscopies in people who are 50 and older? Physicians could identify those patients at risk and who would benefit from preventative treatment long before cognitive symptoms occur.

If this approach became standard, the number of people with Alzheimer’s in the future could possibly be half of what is currently projected, driving tremendous savings in the healthcare systems and, more importantly, increasing the quality of life for millions of potential patients and their families.

What this means for the pharmaceutical companies could be huge as well. Currently, a few companies are already pursuing this bold new treatment approach in their clinical study designs. Eisai/Biogen (BIIB/ESALY), Eli Lilly (LLY), and Roche (RHHBY) all have studies underway to include people at risk (i.e., with high amyloid measures before any significant behavioral symptoms), and as a result, these companies could find themselves in one of the biggest pharmaceutical markets to date.

Under this new treatment paradigm, the Alzheimer’s treatment population would increase from patients with Alzheimer’s symptoms to everyone at risk for Alzheimer’s. Additionally, this population would be taking the medicine for longer than the original forecasts projected because patients could start treatment as much as 10 years ahead of when Alzheimer’s symptoms would have started, giving these people a greater likelihood of living longer because of the medication.

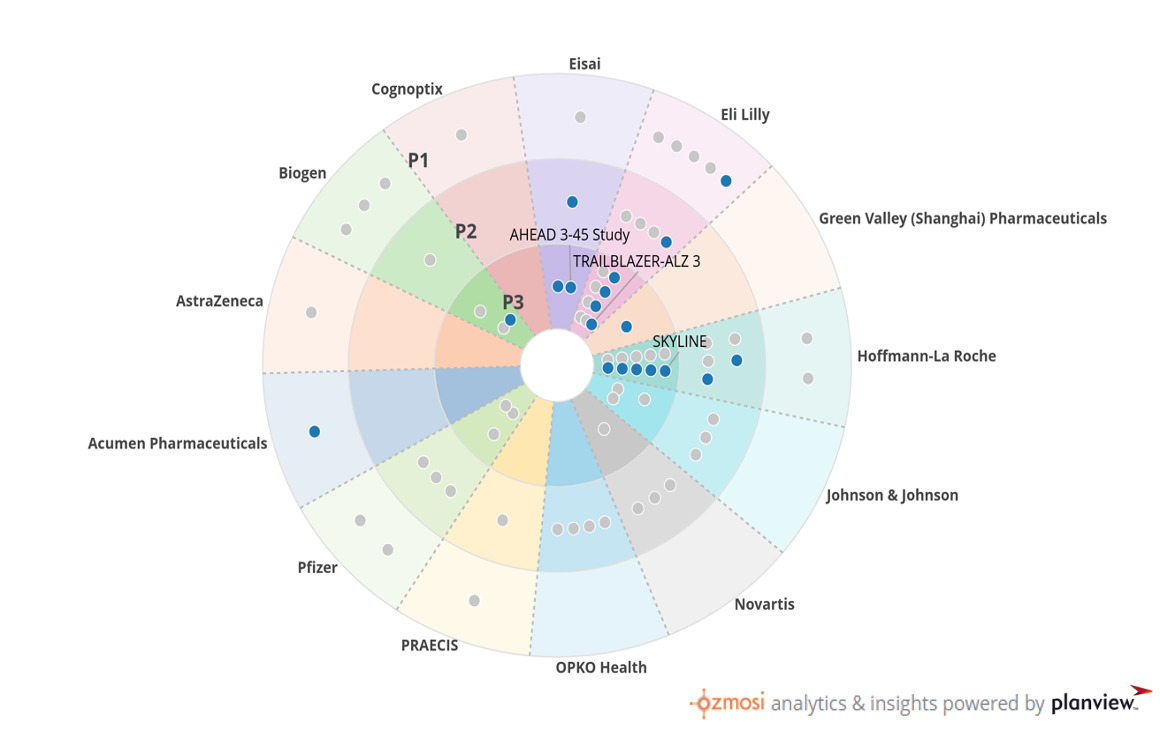

How We Use BEAM to Understand the Market Landscape

We created this graphic using BEAM, our clinical trial tracking and reporting tool that captures trends and categories through intuitive visuals and dynamic views. This landscape view highlights the twelve companies with clinical investment in AB Degraders for the treatment of Alzheimer’s. Each circle represents a clinical trial, blue for active trials and gray for completed trials. The companies at the front of the pack in the prevention of Alzheimer’s are Biogen/Eisai (AHEAD), Elli Lilly (Trailblazer-ALZ3), and Roche (SKYLINE)

Implications of this New Treatment Paradigm on Product Forecasts

Our preliminary analysis shows that the early entrants in this market are likely almost double the initial (and already very large) forecasts for Alzheimer’s. However, like the heart disease example given earlier, this opens the door for many more players to enter or re-enter this market.

Market Dynamics Expected with this New Treatment Paradigm

Currently, there are five companies in active clinical development with AB Degraders and another seven with clinical experience that we might see reignited based on the results of the ongoing trials for the prevention of Alzheimer’s. While these latecomers won’t enjoy the same benefits that the early pioneers Eisai/Biogen, Eli Lilly, and Roche have, there will be a significant market available to later entrants as well. The dynamics of the market are likely to be similar to the statin market, crowded but with each new entrant bringing differentiating factors, combination therapies, and competition for pricing – all of which should drive positive results overall for patients, their families, and the healthcare system.