Pharmaceutical companies are being pushed aside when it comes to who is driving clinical outcomes.

Despite the growing number of industry trials year over year, the pharmaceutical industry is taking a back seat to the even faster growing hospital groups and universities in the same space. Looking back to the year 2000, 8 out of the top 10 clinical trial sponsors were large pharmaceutical companies. Historically, over the same time period, pharma companies accounted for more than 30% of all clinical trials.

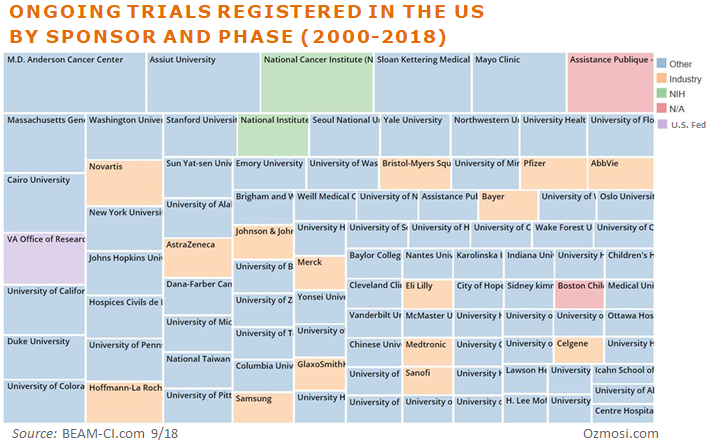

Today, not a single pharmaceutical company rises to the level of top 10 clinical trial sponsors, and they account for only half of their historic clinical trial ratio of industry trials to other sponsored trials (16%). Non-industry sponsors appear in blue.

Top clinical trial players to watch are hospital groups and universities.

For those following the industry, this may be quite the surprise, especially given the large increase in clinical studies over the last 10 years or so. As fast as the industry has grown in this area, the non-industry trials starts have grown even faster, leaving the industry far behind.

For those following the industry, this may be quite the surprise, especially given the large increase in clinical studies over the last 10 years or so. As fast as the industry has grown in this area, the non-industry trials starts have grown even faster, leaving the industry far behind.

Our initial analysis identified a few potential drivers of this powershift in the clinical trial landscape.

- In the last decade we’ve seen a trend towards large hospital groups forming and, therefore, outnumbering the pharma companies in terms of total clinical trials.

- The pharma industry has moved increasingly over the last 10 years from research and development to ‘license and develop’, moving earlier and earlier into the university space and making deal terms for options in exchange for funding research.

- Some disease areas are an ever-growing burden for the treaters and the payors, but they are not being properly addressed by the pharma industry. Some of these areas include schizophrenia, depression and substance abuse.

- As we move forward with increasingly complex treatment algorithms, especially in cancer treatment, the pharmaceutical companies are not delivering what is needed by the hospital groups in terms of treatment sequencing, resistance, and health economics outcomes, so the hospital groups are conducting their own studies.

We will continue to keep an eye on the drivers of this shift but one thing is clear. The future of healthcare and those who will determine its course is shifting to those who actually do the treating and away from those who make the drugs.